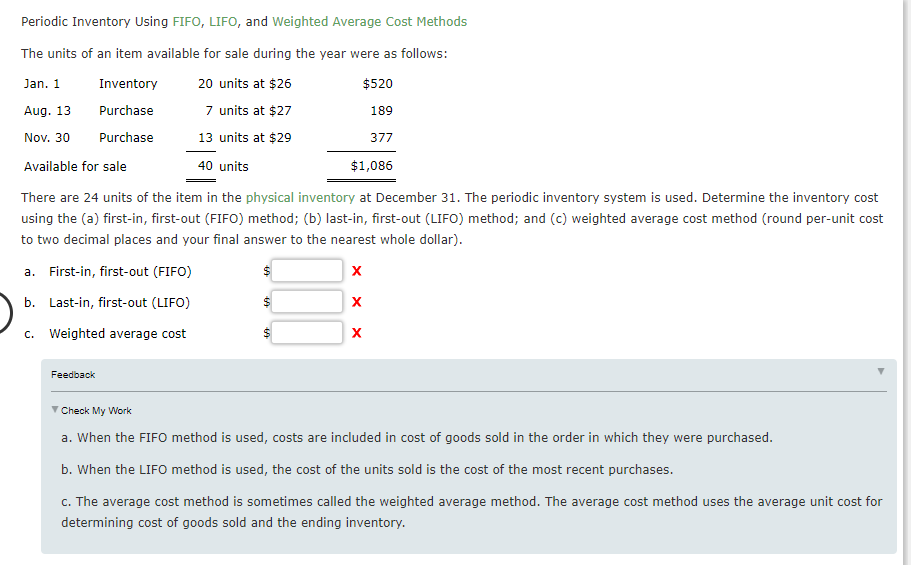

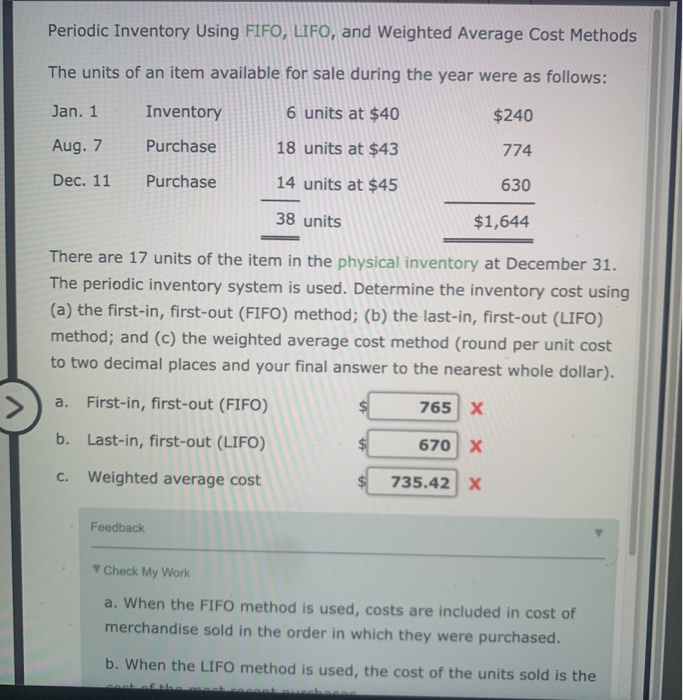

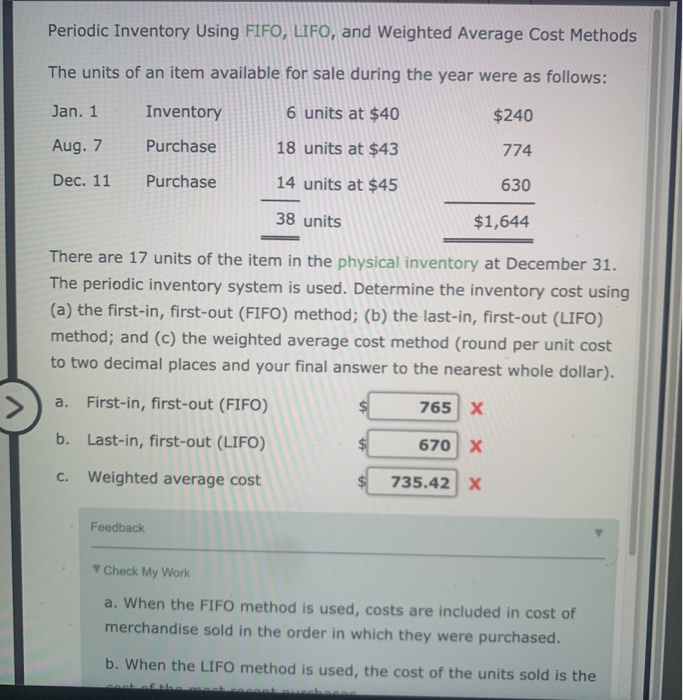

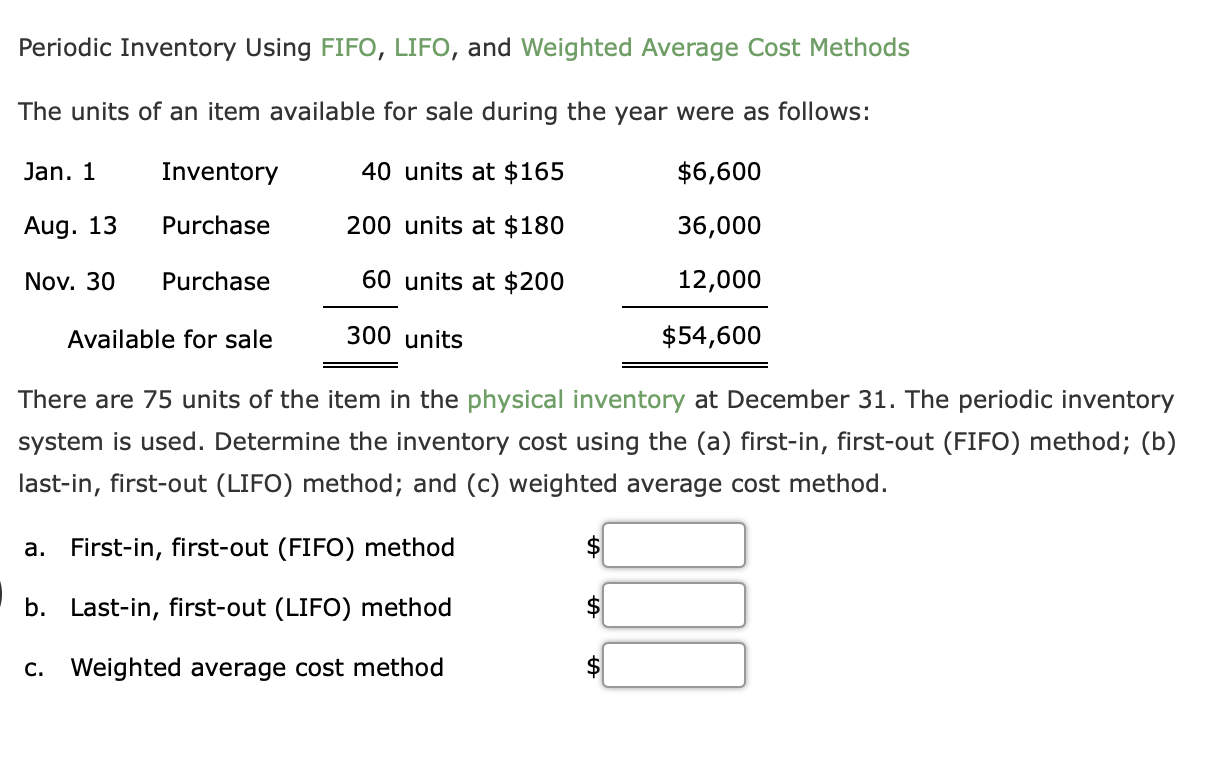

Periodic Inventory Using Fifo Lifo and Weighted Average Cost Methods

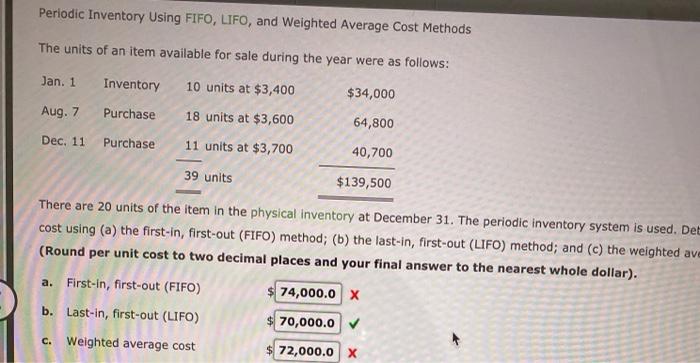

First in first-out FIFO b. Periodic Inventory Using FIFO LIFO and Weighted Average Cost Methods The units of an item available for sale during the year were as follows.

Solved Periodic Inventory Using Fifo Lifo And Weighted Chegg Com

7 Purchase 18 units at 36 648.

. The periodic inventory system is used. The 350 of inventory cost consists of 85 87 89 89. The periodic inventory system is used.

B LIFO last-in first-out Inventory 125400 26000 76800. 200 chairs at 10 per chair 2000. B last- in first-out LIFO method.

Total units of the period 45. Under first-in first-out FIFO method the costs are chronologically charged to cost of goods sold COGS ie the first costs incurred are first costs charged to cost of goods sold COGS. 7 Purchase 19 units at 44 836 Dec.

B the last-in first-out LIFO method. In a periodic inventory system the company does an ending inventory count and applies product costs to determine the ending inventory cost. If you want to read about its use in.

B last- in first-out LIFO method. Total inventory cost of the period 64800 108000 97200 270000. Determine the inventory cost using a the first-in first-out FIFO method.

1 Inventory 13 units at 34 442. C Weighted average cost method. And c weighted average cost method round per-unit cost to two decimal places and your final answer to the nearest whole dollar.

11 Purchase 13 units at 46 598 45 units 1967 There are 16 units of the item in the physical inventory at December 31. First In First Out FIFO and Weighted Average. B the last-in first-out LIFO method.

B last-in first-out LIFO method. Determine the inventory cost using the a first-in first-out FIFO method. The units of an item available for sale during the year were as follows.

1 Inventory 15 units at 28 420 Aug. The periodic inventory system is used. Two types of Inventory accounting systems are.

Periodic Inventory Using FIFO LIFO and Weighted Average Cost Methods The units of an item available for sale during the year were as follows. And c weighted average cost method round per-unit cost to two decimal places and your final answer to the nearest whole dollar. Ending inventory Beginning inventory Purchases made during the month Units sold during the month 500 units 1500 units 1400 units 600 units 800 units 700 units 1500 1 First in first out FIFO method.

300 chairs at 20 per chair. Periodic Inventory and Perpetual Inventory SystemThere are also two Standard costing approaches. And c the weighted average cost method Round per unit cost to two decimal places and your final answer to the nearest whole dollar.

First-in first-out FIFO b. Determine the inventory cost using a the first-in first-out FIFO method. The periodic inventory system is used.

The cost of ending inventory and the cost of goods sold is determined using various methods of them the commonly used methods are. The periodic inventory system is used. FIFO Periodic FIFO Perpetual Weighted Average Periodic.

Determine the inventory cost using the a first-in first-out FIFO method. Under periodic LIFO we assign the last cost of 90 to the book that was sold. First-in first-out FIFO Last in first-out LIFO and.

Periodic Inventory Using FIFO LIFO and Weighted Average Cost Methods The units of an item available for sale during the year were as follows. A FIFO first-in first-out Inventory 146480 90720. And c weighted average cost method round per-unit cost to two decimal places and your final answer to the nearest whole dollar.

The periodic inventory system is used. Determine the inventory cost using the a first-in first-out FIFO method. And c weighted average cost method round per-unit cost to two decimal places and your final answer to the nearest whole dollar.

Number of units in ending inventory. 1 Inventory 13 units at 41 533 Aug. The periodic inventory system is used.

B the last-in first-out LIFO method. Determine the inventory cost using a the first-in first-out FIFO method. The periodic inventory system is used.

B last-in first-out LIFO method. Using the weighted average cost method yields different allocation of inventory costs under a periodic and perpetual inventory system. B last-in first-out LIFO method.

Resulting in four methods for determining Ending Inventory costs. B the last-in first-out LIFO method. B last-in first-out LIFO method.

Determine the inventory cost using a the first in first- out FFO method. And c the weighted average cost method round per unit cost to two decimal places and your final answer to the nearest whole dollar. First-in first-out FIFO.

11 Purchase 14 units at 33 462 47 units 1440 There are 20 units of the item in the physical inventory at December 31. Determine the inventory cost using the a first-in first-out FIFO method. There are 18 units of the item in the physical inventory at December 31.

11 Purchase 10 units at 37 370 41 units 1460. 1 Inventory 15 units at 31 465 Aug. Determine the inventory cost using the a first-in first-out FIFO method.

7 Purchase 18 units at 31 558 Dec. 11 Purchase 15 units at 34 510. Average cost 20700045 4600.

This article explains the use of first-in first-out FIFO method in a periodic inventory system. And c weighted average cost method round per-unit cost to two decimal places and your final answer to the nearest whole dollar. And c the weighted average cost method round per unit cost to two decimal places and your final answer to the nearest whole dollar.

WAC weighted average cost The WAC Method under Periodic and Perpetual Inventory Systems. And c the weighted average cost method Round per unit cost to two decimal places and your final answer to the nearest whole dollar. The weighted average costs using both FIFO and LIFO considerations are as follows.

And c weighted average cost method round per-unit cost to two decimal places and your final answer to the nearest whole dollar. Last in first out LIFO method. Periodic Inventory Using FIFO LIFO and Weighted Average Cost Methods.

First-in first-out FIFO 31200 X b. If two books were sold 90 would be assigned to the first book and 89 to the second book The remaining 350 440 - 90 is reported as the cost of the ending inventory. All expenditures needed to acquire goods and to make them ready for sale are included as the inventorial cost.

First in first out FIFO method. The periodic inventory system is used. The periodic inventory system is used.

We need to determine the inventory cost using different cost methods. 7 Purchase 15 units at 32 480 Dec. First-in first-out FIFO b.

Determine the inventory cost using the a first-in first-out FIFO method.

Solved Periodic Inventory Using Fifo Lifo And Weighted Chegg Com

Solved Periodic Inventory Using Fifo Lifo And Weighted Chegg Com

Solved Periodic Inventory Using Fifo Lifo And Weighted Chegg Com

No comments for "Periodic Inventory Using Fifo Lifo and Weighted Average Cost Methods"

Post a Comment